Abstract

Background

Although the complexity and length of treatment is connected to the newborn’s maturity and birth weight, most case-mix grouping schemes classify newborns by birth weight alone. The objective of this study was to determine whether the definition of thresholds based on a changepoint analysis of variability of birth weight and gestational age contributes to a more homogenous classification.

Methods

This retrospective observational study was conducted at a Tertiary Care Center with Level III Neonatal Intensive Care and included neonate cases from 2016 through 2018. The institutional database of routinely collected health data was used. The design of this cohort study was explorative. The cases were categorized according to WHO gestational age classes and SwissDRG birth weight classes. A changepoint analysis was conducted. Cut-off values were determined.

Results

When grouping the cases according to the calculated changepoints, the variability within the groups with regard to case related costs could be reduced. A refined grouping was achieved especially with cases of >2500 g birth weight. An adjusted Grouping Grid for practical purposes was developed.

Conclusions

A novel method of classification of newborn cases by changepoint analysis was developed, providing the possibility to assign costs or outcome indicators to grouping mechanisms by gestational age and birth weight combined.

Similar content being viewed by others

Introduction

Prematurity is related to a higher risk of health impairment.1 With a preterm birth rate of 11% globally, the burden of disease and the economic impact is high.2,3,4 Already in 1902, it was stated that “neither fetal size nor weight can be regarded as sure indications of fetal age”.5 Gestational age (GA) and birth weight (BW) are both related to resource consumption.6 Until now the questions remain: Does the complexity and length of treatment rather depend on the maturity of the newborn or the BW? Where are cut-off values for these variables and how can we deal with them?7,8,9

Easy to measure with precision, BW does not necessarily reflect the developmental stage or outcome.5,9,10,11 GA estimates based on ultrasound examinations in early pregnancy allow a very precise gestational dating.12,13,14,15 In Switzerland, the national medical statistic dataset16 contains both variables. This dataset is part of price calculations (Swiss Diagnosis Related Groups, SwissDRG).17

DRG systems are used for case-mix trending, quality monitoring, benchmarking, and price negotiations. For these purposes, it is essential to know the accuracy of classification as pricing models are dependent on differentiated coding and the validity of data.18,19,20,21,22 Additional clinical data elements might influence the predictive power and clinical usability of the classification systems, e.g., the proposed variable GA.8,23,24

Different national health care systems implemented the variable BW for calculating prices but until recently GA has not been relevant. Discussions about cut-off values for both variables have been held for decades10,25 but no applicable function has been developed so far.8 Only recently, the Nordic DRG system and the Australian Independent Hospital Pricing Authority have introduced the GA of 37 weeks as a cut-off value but without further refinement.23,26 The SwissDRG system uses fixed BW classes for initial grouping.17 The groups of a BW of ≥2000 g are characterized by an increasing variance of costs, especially the group of late preterms with an insufficient reimbursement.2,27 The variability of BW within the groups of GA categories does not only reflect the expected physiological variance. Outliers like small-for-gestational age and large-for-gestational age are associated with pathologies.7,8,9,10,11,28,29,30,31,32 Therefore, the relevance of fetal morbidities, the individual’s treatment like ventilation, or operative interventions and complications have to be acknowledged when analyzing intensity of treatment and resource consumption.24,33 Most DRG systems as well as SwissDRG integrated variables like comorbidities and operation room procedures in addition to BW. In general, the SwissDRG system already resulted in DRG groups with a high homogeneity of costs.

The Swiss cost accounting for inpatients’ cases follows a distinct accounting standard for hospitals.34 The diagnoses and treatment of each inpatient encounter are coded and administrative information (e.g., BW and GA) added. An enquiry to adopt the variable GA to the SwissDRG system was put forward on behalf of the authors in 2018 to be partially implemented in 2020.35

The objective of our study is to define cut-off values for BW and GA combined to improve the cost depending variability in the resulting groups. The hypothesis of this study is that with regard to calculated changepoints (CPs) the use of the GA as a grouping variable in combination with BW reduces the variability of costs per group. The resulting categorization is meant to contribute to groups of consistent homogeneity to improve medical classification and appropriate reimbursement.

In this explorative retrospective observational cohort study, we used anonymized administrative data of newborn inpatient cases from 2016 through 2018.

Methods

Methods’ summary

In contrast to the current approach of grouping by BW, we aim at GA to complementarily improve grouping. We investigate whether a cost improvement in grouping can be achieved using changepoint analysis (CPA)36 and summarizing the results.

CPA-based groups are found by ordering, summarizing, and interpolating data and subsequently searching for distributional differences as means and variances. This process is conducted separately for both BW and GA aggregated costs. The resulting grid allows classifying newborn cases by both variables for reimbursement and medical purposes.

Patients and data

Setting and study population

This population study was conducted at a Swiss Tertiary Care Center, Swiss standard Level III Neonatal Intensive Care Unit. The population included neonates from 2016 through 2018, admitted by delivery, transfer, or readmission.

Variables

Routinely collected health data from administrative, business, and clinical data warehouse sources were used. Data were collected by coding (certified standard process) and accounting (certified hospital standard for inpatient cases) approximately 2 weeks after discharge.

GA and BW were documented by a standardized documentation process immediately after delivery. With few exceptions, the value of ultrasound measurement in the first trimester was used to confirm GA. GA was documented in weeks plus days. GA in days was computed. BW was measured before discharge from the delivery ward (g).

Data

At the Inselspital, the inpatients’ administrative and accounting data reach a high quality and completeness. Cost accounting follows the Swiss accounting standard for hospitals, Rekole®, which implies a mandatory certification. Only for stillborn cases, no costs are accounted. The reporting on data quality by the cantonal administration (Gesundheits- und Fürsorgedirektion Bern) did not reveal any errors during the years from 2012 to 2017, 2018 still pending. The external revision (annually, mandatory), audits (mandatory internal control system, ISO), internal monitoring, and monitoring of accounting by the invoice recipients show small numbers of cases to be corrected.

The population included all neonates from 2016 through 2018 (n = 8461), admitted by delivery, transfer, or readmission, including multiple births. Stillborn cases (n = 64), early deaths and transfers (until 5 days of age as defined by SwissDRG; n = 58), cases with operation room procedures (n = 544), or missing values (n = 758) were excluded leaving a study population of 7037 cases. The range of GA was 175–298 days; the range of BW was 350–5525 g.

Study design and measurements

The data were collected from November 1, 2015, through December 31, 2018 and analyzed from January 1, 2018 through March 31, 2019. The study population of this retrospective cohort study was categorized by GA (World Health Organization (WHO) criteria37) and BW groups (criteria of SwissDRG,38 being more refined than the WHO criteria): extremely preterm infants <28 (<196 days), very preterm 28/0–31/6 (196–223 days), moderately preterm 32/0–33/6 (224–237 days), late preterm 34/0–36/6 (238–258 days), term 37/0 (259 days) and more for the variable GA and <750 g, 1000–1249 g, 1250–1499 g, 1500–1999 g, 2000–2499 g, 2500 g and more for the variable BW. The categorized BW groups were analyzed for distribution of GA. The study population was tested for multicollinearity of both variables (Variance Inflation Factor, Kendall’s Rank Correlation Coefficient, Spearman’s rank correlation coefficient, Pearson’s Correlation Coefficient).

As depending on the GA and BW the case-related costs vary because of varying intensity of treatment, it is possible to find distributional differences within the cost data.4 Shifts in parameters like means or variances allow the derivation of cut-offs.

We applied a CPA on ordered and partially interpolated data to investigate whether data-inherent distributional shifts within the cost variable in association with GA can be found, which in turn could be used as cut-offs for grouping.

Changepoint analysis

The count of identified CPs is dependent on the penalty value, which is applied for a user-defined range when using the pruned exact linear time (PELT) algorithm.36 Up to several thousands of CPs can be identified with only a few of value for the investigation. We chose a number of CPs similar to the current system (i.e., 5–6).

The CPA relies on ordered timeline data to assess parametric differences between segments of the data based on likelihoods. In the case of one CP, the analysis can be formulated as hypothesis testing, where the null hypothesis stands for no CP, and the alternative hypothesis for one CP.36 The decision whether a CP m is at a proposed location relies on maximization of the log likelihood of the occurrence of the CP:

where τi represents the proposed location of the CP and \(\widehat {\theta _i}\) the proposed parameter(s) of the data segments. The term to maximize is therefore

which is further compared against the chosen threshold c. If λ > c, we reject the null hypothesis, thus concluding the occurrence of a CP, choosing c exploratively. Furthermore, this approach is extendable to find multiple CPs within a time series. The detection commonly relies on the minimization of

where C is a cost function for the segment, and βf(m) a penalty term to counteract overfitting, similar to threshold c. In our study, we focus on the PELT algorithm to achieve the desired minimization of the above equation. While bearing similarities to the segment neighborhood algorithm, it is computationally more efficient through several assumptions, i.e., linear propagation of the number of CPs with increasing data size.36

Finding CPs with the costs showing shifts for both variables is defined as improvement. We chose arbitrary CPs and checked distributional properties of groups. The coefficient of determination (R2) was calculated for the resulting groups.

Grouping grids

To visualize the practical implication, we set up three Grouping Grids: the original classification, the CPs defined by the CPA, and the adjusted CPs usable for practical grouping The adjusted Grouping Grid is based on the assumption that (i) with some of the groups being small in numbers and (ii) with easy to handle thresholds a more simplified grid would be preferable for practical purposes.

Software

Medical Coding Software SAP IS-H, Medical Coding Tool ID Diacos, Clinical Data Phoenix CGM, Business Data WareHouse SAP BW, Microsoft Excel 2010, R developing software (version 3.5.0 (2018–04–23); RStudio version 1.1.453; RStudio Team (2016); and RStudio: Integrated Development for R. RStudio, Inc., Boston were used.

Ethics

The Ethics Committee of the Canton Bern approved our study (BASEC-Req-2017–00333). Informed consent was not necessary, as the analyses were done with routinely collected data for quality assurance purposes.

Results

Study population

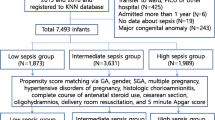

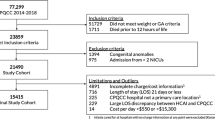

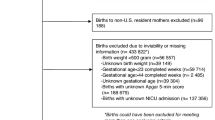

The study population’s BW groups of the included 7037 cases show a heterogenous distribution of GA, see Fig. 1.

The overall multicollinearity (assessed through the Variance Inflation Factor) of all cases’ GA and BW is 3.07, the Kendall’s tau and Spearman’s rho are 0.52 and 0.69, respectively (95% confidence intervals (CIs): 0.5011, 0.528; 0.6681, 0.7041; respectively), and the linear correlation coefficient is 0.82 (Pearson’s Correlation Coefficient, CI: 0.8122, 0.8298).

Changepoints

Using 6 BW and 5 GA ranges, the CPA results in 20 groups instead of 7 original BW groups, see Tables 1 and 2.

Eleven of the groups contain at least 1% of cases each. The size of the groups varies from 4 to 4751 cases within the unadjusted and from 4 to 4908 within the adjusted CPA groups. The CPA contributes most to a differentiation in relation to GA 3 and 4 in both CPA groups and with cases of >2500 g BW (6 instead of 1). For all groups with >10 cases, a reduction of R2 in the CP-defined groups can be observed. Defining the adjusted CPA groups, the results differ slightly from the unadjusted CPA, see Table 2 lower part adjusted.

Grouping grid and distribution of costs

The results of the CPA including thresholds and an analysis of distribution of log-10 costs are displayed in Figs. 2–4.

Distribution of costs and Grouping Grid original BW. a Case-related costs original BW groups (x = BW in g; y = case-related costs in CHF); b Log10 costs original BW groups (log10 case-related costs in CHF); c Grouping Grid original BW groups (x = GA in days, y = BW in g). d Case-related costs unadjusted CPA groups (x = BW in g; y = case related costs in CHF); e Log10 costs unadjusted CPA groups (log10 case-related costs in CHF); f Grouping Grid unadjusted CPA groups (x = GA in days, y = BW in g). g Case-related costs adjusted CPA groups (x = BW in g; y = case-related costs in CHF); h Log10 costs adjusted CPA groups (log10 case-related costs in CHF); i Grouping Grid adjusted CPA groups (x = GA in days, y = BW in g)

The distribution of costs shows that comparing the 3 Grouping Grids (original BW, CPA unadjusted, and CPA adjusted) an improvement can be achieved especially in the groups with ≥2000 g BW (referring to the original BW groups). The variability of costs is higher in the higher GA and BW classes when grouped by any of the three grids.

An adjusted simplified Grouping Grid could be defined, see Fig. 5.

With an adjustment to rounded values, a nearly identical distribution of costs is achieved. Applying the adjusted Grouping Grid, the classification of the cases shows a more refined pattern, visualized in Supplementary Fig. S1 for all cases and in Fig. 6 more detailed.

Discussion

Due to a high variability of costs related to health care in neonatology, specific and differentiated models to group cases are indispensable for price calculation and reimbursement.34 In this study, we could show that applying a novel method to integrate GA as a variable improves the current categorization by BW alone. Not only the aspect of cost distribution and variability justifies the approach but also clinical experience and outcome studies support the necessity to give more attention to the maturity of the newborn in classification systems.28 The formulated groups we proposed here can also be relevant in the clinical context, as costs might reflect the severity of the health conditions.24

Data and method

Changepoint analysis

With the CPA, it becomes possible to formulate group cut-offs, which correspond to changes of distributional properties of a variable. In our case, the ordered variables (i.e., the “timeline”) are GA and BW, which are individually, i.e., univariately, segmented by CPA on behalf of the cost variable. The number of CPs heavily depends on the chosen penalty value used for CPA.36 To assess a reasonable number of CPs, elbow plots may be used plotting the CP count against the penalty value, which is iteratively increased during CPA by the PELT algorithm. By means of these plots, the approximate transition from many to fewer CPs can be visually demonstrated, although it is still questionable whether a choice found on elbow plots is optimal. The choice of CPs used in this study aims at preserving the number of cut-offs used for the BW (i.e., 5–6) for practical reasons.

Two methodological caveats may introduce ambiguities. First, missing data and handling thereof by linear interpolation causes CPs to appear where no assumption on their occurrence can be made. Second, the process of summarization may bias the identification of CPs by the choice of the measure of central tendency, such as arithmetic means or medians, as information is lost depending on data density and distribution. Both problems are most relevant for the lower bounds of the data (i.e., GA 175–200 days and BW 300–1500 g) with data density being low and highly variable for costs.

The cost handling is difficult to interpret, as we univariately process two variables by CPA to achieve an improved grouping on behalf of a third variable. Nevertheless, the approach appears promising by showing smaller ranges of variation for the cost per group. This is caused rather by the reorganization of the data than the elimination of variability. Each group is intended to become constant in terms of mean and variance. The total data variance remains the same, as we do not introduce or remove any data. The method might be improved by computing the CPs using the joint distribution of both BW and GA. However, the results of a CPA using data of a distinct population may be applied to this specific population or subsets of it only. This is not only due to the methodological implications but also due to regional and ethnic differences of growth curves.39

Grouping grids

By using cut-offs for both variables, a Grouping Grid emerges. Each cell of the grid forms a BW and a GA group of constant case-related costs.

The unadjusted Grouping Grid using the calculated cut-off values shows a similar distribution of cases and case-related costs as the adjusted grid.

The adjusted Grouping Grid as a model of classification is based on the idea that (i) with the resulting groups not being small in numbers and (ii) with easy-to-handle thresholds (rounded values), it would be of higher relevance to practical users. Outliers (e.g., macrosomia or intrauterine growth restriction) should be analyzed in further studies to correlate their condition to maternal, placental, and fetal pathologies, which themselves could be independent variables in grouping systems.

Summary

The calculated CPs reduce variability of case-related cost and thus may contribute to consistent reimbursement when applied to grouping systems and calculated for the corresponding population.

The method might also be applicable to other variables like age, laboratory values, or stages of disease and serve not only for cost analysis but also for outcome or staging classification.

Our approach to use a CPA for patient classification including GA and BW as variables should be validated with a larger study population. In Switzerland, this could be done by using the national medical and the cost accounting data administered by the SwissDRG holding.

Limitations

Limitations of the study are the calculation of the CPA model using cross-validation techniques in order to improve robustness. Also we exploratively tested one method without taking alternative methods like cluster analysis into account. The specific CPA as conducted here is only applicable with a high consistency of case-related costs. Not all health care systems deliver case-related costs and therefore might not refer to our method. Moreover, the exact GA has to be registered, which limits the applicability to neonatal care in high resource settings depending on the availability of a highly reliable ultrasound assessment.

Conclusions

A novel method of neonate classification by CPA is proposed. The groups defined by the CPs reduce variability of case-related cost and thus may contribute to consistent clinical groups and reimbursement when applied to grouping systems. This provides a framework for understanding the inherent strengths and weaknesses of each system and for interpreting the statistical performance of each system. Using this proposed method to develop Grouping Grids, the novel classification schemes will contribute to payment equity of case-mix grouping schemes worldwide.

The hypothesis that with regard to calculated CPs the use of the GA as a grouping variable in combination with BW reduces variability of costs per group could be confirmed.

References

Blencowe, H. et al. Born too soon: the global epidemiology of 15 million preterm births. Reprod. Health 10, S2 (2013).

Jacob, J. et al. Cost effects of preterm birth: a comparison of health care costs associated with early preterm, late preterm, and full-term birth in the first 3 years after birth. Eur. J. Health Econ. 18, 1041–1046 (2016).

Petrou, S., Yiu, H. H. & Kwon, J. Economic consequences of preterm birth: a systematic review of the recent literature (2009–2017). Arch. Dis. Child. 104, 456–465 (2019).

Soilly, A. L., Lejeune, C., Quantin, C., Bejean, S. & Gouyon, J. B. Economic analysis of the costs associated with prematurity from a literature review. Public Health 128, 43–62, (2014).

Ballantyne, J. W. The problem of the premature infant. BMJ 1, 1196–1200 (1902).

Gilbert, W. M., Nesbitt, T. S. & Danielsen, B. The cost of prematurity: quantification by gestational age and birth weight. Obstet. Gynecol. 102, 488–492 (2003).

Norris, T. et al. Small-for-gestational age and large-for-gestational age thresholds to predict infants at risk of adverse delivery and neonatal outcomes: are current charts adequate? An observational study from the Born in Bradford cohort. BMJ Open 5, e006743 (2015).

Kohn, M. A., Vosti, C. L., Lezotte, D. & Jones, R. H. Optimal gestational age and birth-weight cutoffs to predict neonatal morbidity. Med. Decis. Mak. 20, 369–376 (2000).

Hoftiezer, L., Hukkelhoven, C. W., Hogeveen, M., Straatman, H. M. & van Lingen, R. A. Defining small-for-gestational-age: prescriptive versus descriptive birthweight standards. Eur. J. Pediatr. 175, 1047–1057 (2016).

Wilcox, A. J. On the importance—and the unimportance—of birthweight. Int. J. Epidemiol. 30, 1233–1241 (2001).

Koller-Smith, L. I. et al. Comparing very low birth weight versus very low gestation cohort methods for outcome analysis of high risk preterm infants. BMC Pediatr. 17, 166 (2017).

Lee, A. C. et al. Diagnostic accuracy of neonatal assessment for gestational age determination: a systematic review. Pediatrics 140, e20171423 (2017)

Urquia, M. L., Moineddin, R. & Frank, J. W. A mixture model to correct misclassification of gestational age. Ann. Epidemiol. 22, 151–159 (2012).

Zhang, G., Schenker, N., Parker, J. D. & Liao, D. Identifying implausible gestational ages in preterm babies with Bayesian mixture models. Stat. Med. 32, 2097–2113 (2013).

Tentoni, S., Astolfi, P., De Pasquale, A. & Zonta, L. A. Birthweight by gestational age in preterm babies according to a Gaussian mixture model. BJOG 111, 31–37 (2004).

Bundesamt für Statistik (BFS). Medizinische Statistik der Krankenhäuser [Internet]. Medizinische Stat. der Krankenhäuser - Var. der Medizinischen Stat. Spezifikationen gültig ab 1.1.2019. https://www.bfs.admin.ch/bfs/de/home/statistiken/gesundheit/erhebungen/ms.html (2019) [Accessed 12 Jun 2019].

SwissDRG AG. Definitionshandbuch AV 2019/2019. SwissDRG Syst. 8.0/2019. https://www.swissdrg.org/de/akutsomatik/swissdrg-system-80/definitionshandbuch (2019) [Accessed 12 Jun 2019].

Zhan, C. & Miller, M. R. Administrative data based patient safety research: a critical review. BMJ Qual. Saf. 12, ii58–ii63 (2003).

Reid, B., Palmer, G. & Aisbett, S. The performance of Australian DRGs. Aust. Health Rev. 23, 20–31 (2000).

Benson, T. & Grieve, G. in Principles of Health Interoperability 135–154 (Springer, Cham, 2016).

Knake, L. A. et al. Quality of EHR data extractions for studies of preterm birth in a tertiary care center: guidelines for obtaining reliable data. BMC Pediatr. 16, 59 (2016).

Schreyö, J., Stargardt, T., Tiemann, O. & Busse, R. Methods to determine reimbursement rates for diagnosis related groups (DRG): a comparison of nine European countries. Health Care Manag. 9, 215–223 (2006).

AU IHPA (IHPA). AR-DRG V8.0. Development of the Australian Refined Diagnosis Related Groups V8.0. IHPA. https://www.ihpa.gov.au/publications/development-australian-refined-diagnosis-related-groups-v80 (2015).

Cheah, I. G. S. Economic assessment of neonatal intensive care. Transl. Pediatr. 8, 246–256 (2019).

Battaglia, F. C. & Lubchenco, L. O. A practical classification of newborn infants by weight and gestational age. J. Pediatr. 71, 159–163 (1967).

Trautner, S. Vejledning i korrekt kodning af diagnose og procedurekoder for neonatale børn i DRG. https://static1.squarespace.com/static/5467abcce4b056d72594db79/t/58ed34635016e19ee2569939/1491940453312 (2017) [Accessed 12 Jun 2019].

Petrou, S. Health economic aspects of late preterm and early term birth. Semin. Fetal Neonatal Med. 24, 18–26 (2019).

Hughes, M. M., Black, R. E. & Katz, J. 2500-g low birth weight cutoff: history and implications for future research and policy. Matern. Child Health J. 21, 283–289 (2017).

Olsen, I. E. et al. BMI curves for preterm infants. Pediatrics 135, e572–e581 (2015).

Grantz, K. L., Hediger, M. L., Liu, D. & Buck Louis, G. M. Fetal growth standards: the NICHD fetal growth study approach in context with INTERGROWTH-21st and the World Health Organization Multicentre Growth Reference Study. Am. J. Obstet. Gynecol. 218, S641.e28–S655.e28 (2018).

Chauhan, S. P. et al. Neonatal morbidity of small- and large-for-gestational-age neonates born at term in uncomplicated pregnancies. Obstet. Gynecol. 130, 511–519 (2017).

Kiserud, T. et al. The World Health Organization fetal growth charts: a multinational longitudinal study of ultrasound biometric measurements and estimated fetal weight. PLOS Med. 14, e1002220 (2017).

Aluvaala, J., Collins, G. S., Maina, M., Berkley, J. A. & English, M. A systematic review of neonatal treatment intensity scores and their potential application in low-resource setting hospitals for predicting mortality, morbidity and estimating resource use. Syst. Rev. 6, 248 (2017).

Besson, P. Zertifizierungsverfahren REKOLE® – H+ Die Spitäler der Schweiz https://www.hplus.ch/de/rechnungswesen/zertifizierungsverfahren-rekole/ (2018) [Accessed 12 Jun 2019].

SwissDRG A. G. SwissDRG Antragsverfahren. https://antragsverfahren.swissdrg.org/swissdrg/issues/index_public?utf8=✓&search=gestation&organisation_with_permission%5B%5D=H%2B&commit=Suchen (2018) [Accessed 12 Jun 2019].

Killick, R., Fearnhead, P. & Eckley, I. A. Optimal detection of changepoints with a linear computational cost. J. Am. Stat. Assoc. 107, 1590–1598 (2012).

World Health Organization. International Statistical Classification of Diseases and Related Health Problems 10th Revision (ICD-10)-WHO Version 2016. https://icd.who.int/browse10/2016/en#!/P05.9 (2016) [Accessed 17 Jun 2019].

SwissDRG A. G. SwissDRG:: Definitionshandbuch. https://www.swissdrg.org/de/akutsomatik/swissdrg-system-70/definitionshandbuch (2018) [Accessed 17 Jun 2019].

Buck Louis, G. M., et al. Racial/ethnic standards for fetal growth: the NICHD Fetal Growth Studies. Am. J. Obstet. Gynecol. 213, 449.e1–449.e41 (2015).

Author information

Authors and Affiliations

Contributions

Conception and design: O.E., K.T., M.N., L.R. Acquisition of data: O.E., K.T. Analysis and interpretation of data and drafting the article or revising it critically for important intellectual content: O.E., K.T., N.T., C.T.N. Final approval of the version to be published: all authors.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

About this article

Cite this article

Endrich, O., Triep, K., Torbica, N. et al. Changepoint analysis of gestational age and birth weight: proposing a refinement of Diagnosis Related Groups. Pediatr Res 87, 910–916 (2020). https://doi.org/10.1038/s41390-019-0669-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41390-019-0669-0