Abstract

Background

The number of healthcare interventions described as ‘personalised medicine’ (PM) is increasing rapidly. As healthcare systems struggle to decide whether to fund PM innovations, it is unclear what models for financing and reimbursement are appropriate to apply in this context.

Objective

To review financing and reimbursement models for PM, summarise their key characteristics, and describe whether they can influence the development and uptake of PM.

Methods

A literature review was conducted in Medline, Embase, Web of Science, and Econlit to identify studies published in English between 2009 and 2021, and reviews published before 2009. Grey literature was identified through Google Scholar, Google and subject-specific webpages. Articles that described financing and reimbursement of PM, and financing of non-PM were included. Data were extracted and synthesised narratively to report on the models, as well as facilitators, incentives, barriers and disincentives that could influence PM development and uptake.

Results

One hundred and fifty-three papers were included. Research and development of PM was financed through both public and private sources and reimbursed largely through traditional models such as single fees, Diagnosis-Related Groups, and bundled payments. Financial-based reimbursement, including rebates and price-volume agreements, was mainly applied to targeted therapies. Performance-based reimbursement was identified mainly for gene and targeted therapies, and some companion diagnostics. Gene therapy manufacturers offered outcome-based rebates for treatment failure for interventions including Luxturna®, Kymriah®, Yescarta®, Zynteglo®, Zolgensma® and Strimvelis®, and coverage with evidence development for Kymriah® and Yescarta®. Targeted testing with OncotypeDX® was granted value-based reimbursement through initial coverage with evidence development. The main barriers and disincentives to PM financing and reimbursement were the lack of strong links between stakeholders and the lack of demonstrable benefit and value of PM.

Conclusions

Public-private financing agreements and performance-based reimbursement models could help facilitate the development and uptake of PM interventions with proven clinical benefit.

Similar content being viewed by others

Appropriate models for financing and reimbursement of personalised medicine are vital to stimulate the development and uptake of these interventions if they are able to show demonstrable clinical benefit. |

Public-private financing agreements and performance-based reimbursement models could help facilitate the development and uptake of PM interventions with proven clinical benefit. |

Defining and measuring performance that reflects the value of PM for the involved stakeholders is still a hurdle to realise the full potential of performance-based reimbursement. |

1 Introduction

Healthcare interventions falling under the umbrella term of personalised medicine (PM) include tests that provide information on patient genotypes, or those which enable drugs to be targeted to patients’ genetics. This information can be used to help predict disease predisposition, suggest preventive actions or stratify treatments [1]. Gene therapies and companion diagnostics are examples of PM interventions that were made possible by the decoding of the human genome and subsequent technological developments [2]. The volume of PM interventions, including gene and cell therapies, is increasing rapidly, and the diagnostics to guide treatment have become a reality. Consequently, United States (US) Food and Drug Administration (FDA) approvals of PM increased from 21 to 39 % during 2014–2020 [3], while the European Union (EU) invested €3.2 billion in PM research in just one year (2017) [4]. International and national initiatives have been launched (e.g., International Consortium for Personalised Medicine) [5] to support research and translation of PM, and government investment in genetic research and development (R&D) and translation was over US$4 billion in 14 countries in 2019 [6]. Furthermore, a personalised approach may yield substantial health benefits and slow healthcare expenditure growth [1, 7]. Given this, governments and public institutions have recently expanded their involvement in the R&D of PM [4, 6].

Despite such initiatives, the translation of PM into clinical practice has been variable [8, 9]. For example, the gene therapy Glybera® was adopted in Germany, but not in France, the UK, Italy or Spain [10]. Reimbursement challenges contribute to these varied adoption rates [11]. Reimbursement agencies make complex investment decisions about PM interventions, with substantial budget impacts, yet the evidence on effectiveness and cost-effectiveness that underpins these decisions is often limited. For example, in the UK the use of histology-independent cancer drugs, such as Vitrakvi® (larotrectinib), is an example of complex reimbursement decisions [12]. The standard approach in oncology is to treat tumours based on their type. However, targeted therapies based on a tumour’s genetic information have recently been developed. Larotrectinib is indicated for any solid tumour with a neurotrophic tyrosine receptor kinase (NTRK) gene fusion. Because many tumour types respond to it, the drug is considered to be 'tumour-agnostic' or 'histology-independent'. The National Institute for Health and Care Excellence (NICE) ultimately approved the use of this therapy, but found the process of appraising a histology-independent treatment to be extremely challenging, because existing assessment methods require technologies to be assessed one at a time. A further example is the withdrawal of several gene and cell therapies from the European market due to high prices (partly related to high R&D costs) and weak evidence of effectiveness [13]. In addition, the misaligned reimbursement for companion diagnostics and medicines has led to the reimbursement of companion tests being dependent on national or local tariffs and hospital budgets, if reimbursed at all [14].

Given this clear variability and the challenges associated with financing and reimbursing PM interventions, it is crucial that appropriate financing and reimbursement models that share financial risk and benefits between stakeholders are identified to stimulate the development and uptake of PM interventions, if proven to be effective and cost effective. An important first step in this work is to describe the current landscape in this context and identify promising examples of models that could support decision makers when faced with reimbursement decisions.

Therefore, the aim of this paper is to review financing and reimbursement models for PM, summarise their key characteristics, and describe their ability to influence development and uptake of PM.

2 Methods

This systematic review adhered to our published protocol [15] and the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) statement [16]. We defined a financing model as a mechanism to fund R&D, and a reimbursement model as a mechanism for purchasing and providing PM. Personalised medicine was defined according to the European Council Conclusion on personalised medicine for patients (2015/C 421/03) as “a medical model using characterisation of individuals’ phenotypes and genotypes (e.g. molecular profiling, medical imaging, lifestyle data) for tailoring the right therapeutic strategy for the right person at the right time, and/or to determine the predisposition to disease and/or to deliver timely and targeted prevention.” [1] The term PM in this review is synonymous with other terms such as precision medicine, individualised medicine, tailored therapy, personalised health care, etc.

2.1 Search Strategy

The search was conducted in Medline, Embase, Web of Science, and Econlit. Grey literature was identified through Google Scholar, Google and subject specific webpages [5, 17,18,19,20,21,22,23]. Search syntaxes and selection criteria are presented in Appendix 1. As the most recent developments in the landscape of financing and reimbursement of PM are relevant for current decision making, our searches were restricted to the period 2009–2019 and were updated to include studies published up to October 2021. This matches the timing of the emergence of novel genomic tests and the increase in submissions to health technology assessment agencies. To ensure all potentially relevant publications were captured, we applied our search strategy to identify reviews on this topic published before 2009 and examined resulting hits.

2.2 Selection Process

Search results were de-duplicated in EndNoteX9 [24], and split equally between three reviewers (AT, JB and RKK) for title, abstract and full text review. To ensure consistency in the selection process, each reviewer screened the titles, abstracts, and full texts of 10 % of the articles screened and selected by the other reviewers as per a previous study [25]. The target for inter-reviewer agreement was 95 %. References and citations of included studies were crosschecked for additional studies using the (reverse) snowballing method [26]. Articles published in English that described models for the financing and reimbursement of PM interventions were included. No restrictions were applied to study location, delivery setting or type of PM. Financing models for the development of non-PM interventions were also included to enable the identification of promising examples that can be potentially applied to fund R&D for PM interventions, but reimbursement models for non-PM were excluded.

2.3 Data Extraction

Data were extracted on the characteristics of the financing and reimbursement models; the type of PM (or non-PM for financing models) considered; country and healthcare system; and the facilitators, incentives, barriers and disincentives to financing and reimbursement that could influence the development and uptake of PM. Facilitators and barriers were factors that were defined as enablers or obstacles, originating from the type of financing/reimbursement model, which in combination with health system, regulatory arrangements, or other factors, could enable or impede the development and uptake of PM interventions. Incentives and disincentives were defined as factors that could motivate or discourage. Stakeholders were defined as representatives of academia, industry, pharmaceutical manufacturers, government agencies, health payers, healthcare provider organisations, patient representatives, e.g., people and organisations with vested interest in PM financing and reimbursement. Extracted data on facilitators, barriers, incentives and disincentives were based on reports in the relevant papers. Facilitators, barriers, incentives and disincentives were classified according to whether they related to evidence generation, financial risk, reimbursement models, health technology assessments (HTAs) or regulatory frameworks. All data were recorded in a standardised Excel form.

2.4 Data Synthesis

Data were synthesised narratively according to the type of proposed or used financing and reimbursement models. We summarised the facilitators, incentives, barriers and disincentives related to financing and reimbursing of PM. Financing models were grouped by source of research funding to identify differences between publicly and privately funded studies. Reimbursement models were grouped into non-risk sharing (or traditional) and either financial-based or performance-based risk-sharing models [27,28,29].

3 Results

After screening 23,877 records, 150 publications and reports were included in the qualitative synthesis process (Fig. 1). Three additional papers were identified through reference and citation screening. The characteristics of the included studies are presented in Table 1. The target set for inter-reviewer agreement of 95 % was achieved. Only four of the included papers were published before 2009, the remainder were published in the period 2009–2021. Thirty-three papers (21.5 %) reported on financing models for research and product development [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62], 87 papers (57 %) reported on reimbursement models that had been proposed [63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82] or used [10, 13, 79,80,81, 83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,147] for PM (Fig. 2) and 33 (21.5 %) were discussion papers [148,149,150,151,152,153,154,155,156,157,158,159,160,161,162,163,164,165,166,167,168,169,170,171,172,173,174,175,176,177,178,179,180]. Fifty-four papers reported on Europe, 88 on North America, 5 on Australasia and 3 on Asia; the remainder either had an international perspective or did not report a specific country or region. The predominant disease area in which reimbursement was reported was cancer.

3.1 Financing of PM Research

Personalised medicine research is financed through various public and private sources, and public-private collaborations [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62] (Table 2). Public financing is provided by the National Institutes of Health in the USA, Medical Research Councils in the UK, dedicated research funds, governments (e.g., Genome Canada funded by the Canadian government), and by different initiatives and programmes of the EU [30, 33, 38, 43, 58, 61, 62]. Private financing includes industry, venture capital and philanthropic funding [35, 40, 42, 55, 59, 60], and mixed public-private financing includes collaborations between academia, government, pharmaceutical and diagnostic companies, charities, and small and medium enterprises [32, 34, 37,38,39, 43,44,45,46,47,48,49, 52, 56, 57]. Two financing models unrelated to PM were identified. In the first model, venture capitalists, called “high-net-worth individuals” [50], privately funded and managed research in areas of their vested interest. In the second model, a specially developed health currency (Healthcoin) was exchanged between payers as a risk-sharing agreement in which future health insurers paid Healthcoins to the previous health insurers of their insured population for engaging in research that would benefit the insured [51].

3.2 Facilitators and Incentives for Financing PM Research

Partnerships between funding organisations, academic institutions, and pharmaceutical companies were described as having the potential to facilitate funding streams and collaborations by providing support and access to non-marketed compounds [31] (Table 3). It was also noted that virtual and venture variants of partnerships could facilitate the financing of new business areas by spreading the capital initially required, and enabling strategic outsourcing and investment instead of costly mergers and acquisitions [46]. It was proposed that “Open source innovation” [39, 56]—the exchange of internal and external ideas and knowledge to advance technology—could replace the traditional in-house-focused approach and incentivise new collaborations [39]. However, it was noted that this required an organisational framework, clarifying factors such as financial and intellectual contributions and asset rights, while maintaining scientific independence [39].

Risk-sharing financing agreements between governments and manufacturers—such as using government grants to subsidise the direct cost of clinical drug development in return for reduced market prices—were suggested as an approach to facilitate innovation, quicker access to, and translation of new products into clinical practice [49]. Similarly, risk-sharing agreements between payers, such as Healthcoin [51], were suggested as means that could incentivise research financing of cures that produce benefits throughout patients’ lifetimes.

Furthermore, it was noted that creating a system based on conditional approval could facilitate R&D funding by decreasing the size of preapproval trials, the capital required for initial development, and the time from trial initiation to approval [49]. It was also suggested that R&D of companion diagnostics could be incentivised by payment of royalties on drug sales or at sales-based milestones—which facilitates sharing of the long-term value of the drug-diagnostic combination—or by compensating diagnostic research companies for the risk of the drug not being approved or not meeting sales targets [53].

Achieving a balance between cost-sharing, risk-sharing, benefit-sharing, and scientific independence was noted to be essential to maintaining public-private partnerships [39]. It was also noted that when most costs are already borne by academia and the government, this could create incentives for pharmaceutical companies to finance and engage in clinical translation as the risk of costly late-stage failure is reduced [32].

3.3 Barriers and Disincentives for Financing PM Research

Barriers to financing research in PM were identified that related to the discordance between research prioritisation decisions on national and local levels [44] (Table 3), legal, intellectual property rights and privacy/ethics issues (such as lack of harmonisation of legal and ethical guidelines concerning data and sample sharing, as well as licensing concerns which require dedicated policies to help overcome them) [45, 48]. Other reported barriers included the lack of strong links between potential industry and academic partners [48] and performance requirements focused on direct practical applicability rather than scientific advancement [30]. Several factors were identified as disincentives associated with financing research to repurpose and reposition drugs using genome-wide approaches, or involving genomic research in early clinical development of drugs. These included the remaining patent life of the drug, and the additional costs for research coupled with an unclear return on investment [31]. The variation in revenue between drugs and diagnostics, and the inadequate intellectual property protection of diagnostics, was also highlighted as a potential disincentive to invest in laboratory developed tests [53].

3.4 Reimbursement Models Used in PM

3.4.1 Traditional Models

Non-risk–sharing reimbursement (i.e., traditional) models are used to reimburse gene, cell and targeted therapies, biomarkers, genetic and genomic tests (Fig. 2, Table 4). For example, Spinraza®, used to treat spinal muscular atrophy, has been reimbursed in the USA on the basis of wholesale acquisition price in the first year and an annual instalment for the duration of patients’ life without considering the performance of the drug [147]. CAR T therapies, Kymriah® and Yescarta® for B cell cancers, have been reimbursed in the outpatient setting on the basis of the wholesale acquisition cost supplemented by additional payment of 6 % of that cost [126, 146]. In the inpatient setting, these therapies have been reimbursed in the USA via a higher-weighted diagnosis-related group (DRG) or the “autologous transplant” DRG supplemented by an add-on payment for new technology, or bundle payment. In Europe they received confidential rebates [85, 126,127,128, 133, 146] (Table 4). DRGs have also been applied in Europe to reimburse Kymriah®, Holoclar®, used to treat moderate to severe limbal stem cell deficiency, and Spherox®, used to treat articular cartilage defects [133]. Imlygic®, used to treat melanoma patients, has been reimbursed in the UK with a narrow indication and at a discounted price [10, 13].

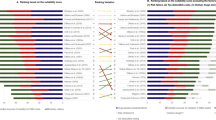

Reimbursement models for personalised medicine. *There are also risk-sharing health funds; MEA managed entry agreement; ORBM Orphan Reinsurer and Benefit Managers; PBRSA Performance-based risk-sharing agreement. 1Used in reimbursing (Molecular) biomarkers including genotyping and phenotyping) and/or targeted therapy; 2Used/proposed in reimbursing gene/cell therapies/targeted therapy; 3Proposed for reimbursing (Molecular) biomarkers including genotyping and phenotyping) and/or targeted therapy; 4Proposed for reimbursing gene/cell therapies/targeted therapy; 5Mentioned as a potential application for reimbursing gene/cell therapies/targeted therapy

Existing fee-based payment models are usually used to reimburse tests. As companion diagnostics and genetic tests do not usually have a dedicated code for reimbursement, existing Current Procedural Terminology (CPT) codes were used to reimburse KRAS, PDL-1, EFGR, HER2-testing, gene panel oncology testing and genetic testing for spinocerebellar ataxia in the USA [88, 92, 119, 124, 137,138,139]. Code-stacking (i.e., use of multiple codes, which are commonly based on the performed laboratory procedures), was applied to reimburse the Mammostrat® and eXagenBCTM tests, as well as molecular pathology tests in the USA [95, 113]. Unit fees were applied to reimburse BRCA1/2 tests in Australia [89] and codes were usually used to reimburse companion diagnostics in France [91, 109]. Molecular diagnostic tests were also reimbursed by incorporating them into existing DRG- and locally and nationally negotiated tariff-based payments (e.g., in EU5 countries: Germany, France, Spain, Italy and UK) [14, 115, 121, 123, 125, 140, 142], or diagnostic costs were covered by state and hospital budgets or pharmaceutical companies [140]. Molecular diagnostics, genetic and genomic tests were also offered as direct-to-consumer tests by online companies and private health providers [90], or covered by third party payers (e.g., social security institutions) [115, 121].

Medicare Part B and D plans in the USA, which provide outpatient medical and prescription drug coverage, are used to reimburse targeted therapies, e.g., ibrutinib, trastuzumab, cetuximab, imatinib, abacavir, etc., but patient co-payments for the specialty-drug tiers, in which these drugs are placed, are high [111, 119]. In Europe (Netherlands and Scotland), targeted cancer therapies (e.g., afatinib, axitinib, bevacizumab, etc.) are reimbursed through existing policies to fund expensive hospital and orphan drugs, and patient access schemes [118].

3.4.2 Risk-sharing Reimbursement Models

Performance-based models are applied to reimburse gene and cell therapies, and some companion diagnostics [83,84,85] (Fig. 2, Table 5). For example, Luxturna©, a gene therapy for inherited retinal disease, has been reimbursed through a risk-sharing pay-for-performance arrangement, which provides rebates if the drug fails to deliver agreed outcomes at 30 days, 90 days and 30 months, including coverage with evidence development [79, 83, 85, 132]. Kymriah®, a CAR-T therapy, has also been reimbursed via a 30-day outcome-based rebate related to achieving complete remission in the paediatric population group in the USA [85, 129, 131]. In European markets, coverage with evidence development and outcome-based rebates or payments in instalments were applied for Yescarta® and Kymriah® [80, 130, 132,133,134]. Strimvelis®, used to treat severe combined immunodeficiency, received reimbursement coverage by the Italian Medicines Agency, supplemented by a limited risk-sharing outcome-based model that provides a rebate in case of treatment failure [10, 13, 86, 87]. The manufacturer of Zynteglo®, a gene therapy for beta-thalassemia, has proposed an outcomes-based model that spreads five equal payments over five years for the key EU markets, including coverage with evidence development in France, Germany and England [80, 132]. Outcome-based and retroactive rebates were also offered in Europe for Zolgensma®, used to treat spinal muscular atrophy [79, 80, 132], and Holoclar® was reimbursed via payment by result in some European countries. ChondroCelect®, applied in treating cartilage defects of the knee, was reimbursed via a risk-sharing outcome-based agreement with yearly rebates for 3 years post-treatment [13] before being withdrawn from the market. OncotypeDX®, a genetic test that predicts the risk of recurrent breast cancer to inform chemotherapy treatment, is an example of a diagnostic test that achieved value-based pricing and reimbursement. The manufacturer entered into a coverage with evidence development (CED) agreement with payers in the USA, offering a discounted price while data were collected. When subsequent evaluations demonstrated the economic and clinical benefits of the test, OncotypeDX® kept its price, which was higher than the price the test would receive had code-stacking been used [84, 104, 105, 122].

Some of the risk-sharing agreements (Table 6) for targeted therapies in the UK and Italy are purely financial and involve partial rebates, free cycles of treatment and discounted schemes, while others consider outcomes of treatment and involve partial costs covered by manufacturers in case of treatment failure (money-back guarantee) [114, 144]. In Italy, the drug bevacizumab is reimbursed on an indication basis depending on the cancer type with an additional discount for advanced colorectal cancer [81]. Targeted cancer therapies were reimbursed in Europe through different financial-based models and managed entry agreements, including discount rebates, price volume agreements and price cap freezes [135, 136].

3.5 Reimbursement Models Proposed for PM

Models that were proposed for reimbursing PM were either financial- or outcome-based [63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,82], (Fig. 2, Tables 5, 6). Performance-based contracts can be short- (one year) or long-term (multi-year), with payments made either upfront (lump sums with rebates paid in case of underperformance), or in instalments (based on the achievement of agreed milestones) [63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82]. Performance-based models could decrease the financial risk to payers as producers would share the cost in case of treatment failure or underperformance, thus overcoming the shortcomings of traditional payment models that are usually based on a one-off upfront lump sum. Value-based reimbursement was proposed as an alternative payment model for companion diagnostics that will allow the clinical utility of the tests to be assessed for a specific use, and a tiered rate then assigned [82].

In financial-based models (Table 6), producers contributed to the cost of PM to reduce the financial uncertainty surrounding the introduction of a new therapy on the basis of agreed financial thresholds and price volumes [76], provision of rebates and discounts, or a certain number of treatment cycles for free, and utilisation caps that limit the number of reimbursed doses per patient [74]. Subscription-based, also referred to as Netflixlike, models that are based on lump sum payment to manufacturers in return for unlimited access for patients over a defined period, have been mentioned in the literature discussing potential reimbursement schemes for PM [78, 80], as well as in papers describing reimbursement of interventions that are not PM [182, 183]. However, their current implementation is limited to reimburse direct-acting antivirals for hepatitis-C virus in Australia and the state of Louisiana so far [182, 183]. Expanded risk pool models have been proposed for reimbursing PM as means to reduce financial burden as third-party public or private payers will cover some of the payment for expensive treatments, e.g., gene and cell therapies [79].

3.6 Facilitators and Incentives for PM Reimbursement

It was frequently asserted that early pre-approval dialogue to agree on outcomes to be assessed and necessary evidence, and the application of performance-based agreements, could facilitate the reimbursement process and incentivise payers to cover PM [83, 86, 162, 165] (Table 7). Coverage with evidence development was often identified as a potential facilitator for reimbursement and adoption of companion diagnostics as it could tackle the issues of generating adequate evidence, improving access for patients, addressing regulatory concerns, simplifying reimbursement decisions, and improving the likelihood and timing of financial gains [84, 93, 119, 122]. Financial-based models, including rebates and volume caps, were pointed out as means to reduce the budget impact of new treatments and improve affordability [13]. Lists of “approved for reimbursement” tests (such as “Palmetto”) [88, 107, 156, 160, 171], and caps on out-of-pocket contributions from patients [92, 111], as well as dedicated pathways for drug-test evaluation and funds were also suggested to facilitate reimbursement and improve clinical utilisation [101, 149]. Co-development of companion diagnostics and drugs was proposed as an approach that could potentially improve test-drug reimbursement by improving the clinical evidence base, but which may also delay market access as R&D and clinical trials could take longer [154, 169]. It was noted that reimbursement of companion diagnostics could potentially be further facilitated by improving coding terminology [107, 112, 113, 119, 156, 160, 161], providing evidence for clinical and cost effectiveness, and inclusion in guidelines [94, 116, 161, 176]. As value-based reimbursement models for companion diagnostics are not widely used in healthcare systems, it was proposed that aligned reimbursement processes of precision mechanism and subsequent treatment based on evidence and HTA could facilitate the reimbursement of such tests [175, 178, 179]. Refinement of value assessment frameworks to include wider economic analyses of direct and indirect costs and benefits, as well as broader value concepts and using financial markets valuation methods were proposed to help achieve the implementation of value-based reimbursement for targeted cancer therapies [173]. It was proposed that innovation should be rewarded on the basis of value and should be flexible with the generation of new evidence and the emergence of competing technologies. Finally, it was noted that the core value elements should include length and quality of life; however, value of knowing should also be incorporated into the paradigm for PM [174].

3.7 Barriers and Disincentives for PM Reimbursement

A key barrier to reimbursing gene and cell therapies was said to be the lack of demonstrable benefit [10, 13] (Table 7). Existing HTA frameworks evaluate these interventions in a similar way to other therapies and reimbursement models are not adapted to reflect the effectiveness of one-off treatments; data for the sustainability of long-term benefits and improvements in quality of life that could be achieved in chronic conditions are uncertain or lacking [10, 87]. In addition, regulatory requirements (e.g., Medicaid Best Price in the USA) were identified that may pose a barrier to introducing annuities [85], as a single instalment may be regarded as “the best price” to which Medicaid will be entitled.

Among the barriers and disincentives for value-based reimbursement of targeted cancer therapies are the lack of differentiated criteria for assessing and recommending these therapies that include wider economic analyses of direct and indirect costs and benefits, and additional elements of value. Thus, positive reimbursement decisions depend on the availability of financial managed entry agreements, including usually confidential discounts [173].

Key barriers for the reimbursement and adoption of molecular and genetic/genomic testing were noted to be the use of existing CPT codes for other tests (cross-walking), the use of code-stacking, and prolonged service codes that were rarely reimbursed [104, 106, 109, 110, 116, 119, 121, 137, 138, 148, 151, 154,155,156, 160, 161, 171, 172]. Variations and inconsistencies in insurance coverage of tests, including whole genome sequencing, and treatments, cost-sharing (e.g. co-payments), varying insurers’ contributions and preauthorisation requests, financial penalties for test ordering and budget capping on number of tests performed [14, 88, 92, 94, 97,98,99,100,101, 108, 109, 115, 117, 119, 121, 123, 151, 159, 161, 162, 176, 178, 179] were also identified as barriers.

Coverage with evidence development in cancer care was rarely applied in some health systems, partly due to a lack of clarity regarding the threshold for coverage initiation, the coverage mechanisms and the increased costs of evidence generation [102]. Performance-based agreements were suggested as a way that may facilitate earlier and quicker access to costly therapies [64, 70, 102], or technologies with yet unproven benefit, but were reportedly difficult to implement in current healthcare systems due to data requirements, high administration costs, and perverse incentives due to switching among payers [70, 86]. In addition, performance-based agreements could disincentivise producers who prefer an upfront, lump-sum payment [73]. The lack of a clear governance structure that outlines the financial flow of the performance-based agreements, ensures the engagement of multiple stakeholders and resolves administrative [132] and financial issues was pointed as barrier to implementing outcome-based reimbursement [177]. If current payers could shift payments towards future payers, this might disincentivise these payers from accepting patients with accrued liabilities due to past treatments [73], and prompt patients to choose insurance providers with a history of coverage [10]. In general, unilaterally set reimbursement levels [167] and infrequent assessments of drugs and diagnostics as treatment packages [115] were identified as the key disincentives for developing a pipeline of innovative tests that require substantial risk-based research.

4 Discussion

Personalised medicine interventions are currently financed through public and private sources, and largely reimbursed through traditional payment models, not specific to PM. Performance-based agreements are used for gene and cell therapies, and some companion diagnostics. The main barriers and disincentives to PM financing and reimbursement that were identified in the literature were the lack of strong links between public and private stakeholders and the lack of demonstrable benefit and value of PM in health technology assessments.

Across multiple papers, there was a degree of confidence that public-private agreements could facilitate financing for R&D of PM and provide opportunities for partners to share and access research facilities, databases, expertise and experience. Traditionally, early R&D in PM was undertaken in academia and small and medium enterprises, with large pharmaceutical companies organising translation [32]. However, this approach to research is evolving, with larger research consortia now pooling research funds, sharing expertise, data and resources. To keep the momentum and scale-up public-private partnerships, it was suggested in the literature that cost-sharing, risk-sharing and benefit-sharing should be carefully balanced, and efforts should be made to maintain scientific independence [39]. This will require clear and widely accepted organisational, financial, and legal frameworks to be in place. Public-private partnerships could serve as a platform for engaging in risk-sharing and outcome-based reimbursement models that improve early access to and uptake of PM, as data sharing agreements could be signed and early-phase evidence could be shared during the R&D phase [181]. However, alternative approaches to partnership were highlighted. These include vouchers or subscriptions for private investors and patients [182] that can be exchanged against healthcare when needed as well as contracts between individual investors and small and medium enterprises similar to social impact bonds that aim to improve social outcomes, are traded in markets [184,185,186] and are increasingly promoted by governments (e.g., in the UK) [187].

Although subscription-based models have been mentioned as potentially suitable to reimburse gene therapy [78, 80], it is unclear how they could be implemented in practice to pay for these one-off, very expensive therapies. It would also be challenging to set the level of the subscription fee to reflect the value of the gene therapy and the uncertainty in the expected outcomes, determine the prescriber (e.g., the patient, their insurer, or the state), and the duration of the subscription. Even if these challenges were overcome, it is still unclear how subscription models could actually solve the affordability issues surrounding gene and cell therapies.

To achieve risk-sharing outcome-based reimbursement agreements, the barriers identified in this review must be overcome. In particular, evaluation frameworks are required that can accurately assess the value of PM interventions. Although value frameworks are in “prime time” [188], it is currently challenging to distinguish the value of diagnostics and their accompanying therapies and to incorporate the benefits of one-off treatments and diagnostics that can alter treatment pathways into reimbursement models in the assessment of PM interventions. The adoption of outcome-based models will depend on establishing systems to collect and analyse necessary data, and on agreeing evaluation outcomes that may go beyond health outcomes to incorporate value elements related to decreased uncertainty, hope, real options, and insurance [189]. Capturing these additional value elements will require consideration of the scope of these studies, and treatment interactions that capture synergy effects between tests and therapies may need to be included [190].

Coverage with evidence development could be an intermediate step to introduce outcome-based models by facilitating access to promising new technologies with unproven benefits while permitting data collection to inform future reimbursement decisions [83, 86, 162, 165]. However, if evidence of effectiveness and health benefits is ultimately unconvincing, it might be difficult to withdraw reimbursement and delist PM interventions [191]. Basing reimbursement on outcomes and agreeing future rebates linked to underperformance could also incentivise payers to provide coverage and access to new PM.

Aligning reimbursement of companion tests and treatments [14] could further incentivise the establishment of value-based care pathways [96, 120, 121], by facilitating the use of cost-effective PM and incentivising the investment in R&D for companion diagnostics. However, at a societal level, value-based pricing might be both unaffordable and unacceptable—especially for highly priced curative therapies and orphan drugs—despite the generated benefits [192].

Global differential pricing of PM across countries with different ability and willingness to pay for both new medicines and diagnostics coupled with reimbursement based on performance could be a potential solution to reimbursement issues [154]. However, this approach is not without its challenges as manufacturers could be disincentivised to offer differential pricing in cases where transparency of pricing is required.

Ideally, financing and reimbursement models should ensure that any surplus that is generated is distributed fairly among stakeholders, however, this is hard to achieve. Another challenge when establishing value-based care pathways based on next-generation sequencing tests (e.g., in the context of tumour agnostic drugs) is whether and how to attribute the cost of testing to existing treatments in cases when more than one actionable mutation is detected.

Theoretical models on financial incentives, rooted in behavioural economics, could be used to support the development of financing and payment models for PM by providing: (a) insight into the risk preferences of individual providers and organisations, (b) arguments about the use of sticks (e.g., penalties) or carrots (e.g., rewards), and (c) an informed perception of the appropriate size of financial incentives [193] and their potential intended and unintended consequences. This theory-based information could be used alongside existing evidence about the effectiveness of financial incentives to select the stakeholders to be involved in the financing or payment model, choose the type and level of the incentive, and construct an optimal risk structure.

On the applied side, financing and payment models should be (a) clear on how to spread the benefits and respective costs of testing, especially of extended gene panel, whole genome and exome sequencing, to different preventive measures and gene and targeted treatments, (b) propose ways to engage multiple stakeholders from the very early stages of R&D to achieving reimbursement coverage, to allow for fair pricing and sharing of value, and (c) incorporate a roadmap for their successful implementation.

Large markets and leading innovators, such as the USA, that contribute more than one-third of the global annual pharmaceutical revenues and produce a large share of PM [3, 194], are key in realising the full potential and value of PM globally. Therefore, international efforts to increase the development and uptake of PM may prioritise the implementation of appropriate financing models for R&D accompanied by payment models that reward innovation and achievement in such countries. It is often these countries that experiment and establish innovative models for financing and reimbursement of healthcare that are later adopted by other countries [132].

Approval and market access do not always guarantee reimbursement coverage and R&D costs of PM may not be adequately reflected in reimbursement. This financial risk may reduce the interest of manufactures to invest in PM and evidence generation through large RCTs. According to our findings, weak evidence is in turn a barrier for successful implementation of performance-based reimbursement models. Therefore, it was argued in the literature that a new paradigm that aligns financing of R&D and reimbursement for PM intervention is needed. This could facilitate the distribution of uncertainty and financial risk of investments between stakeholders and incentivise investment in R&D. A possible way to achieve this is to expand the scope of public-private financing agreements to include the terms of reimbursement in case the PM intervention proves to meet the expectations of the involved parties.

Reimbursement challenges that are barriers to clinical implementation and adoption, and provide disincentives for research, development and innovation, are not unique to PM. New expensive antibiotics have faced reimbursement issues, albeit for different reasons such as the caps on prescription and prices, and the well-established generic market [195].

The strengths of our review included the extensive search of scientific databases and grey literature, and the detailed data extraction that allowed us to identify promising models for PM. The main limitation was that we did not assess the quality of the included studies, as our aim was to summarise options for financing and reimbursement of PM, rather than judging the quality of individual studies.

5 Conclusion

Our study shows that current barriers in the implementation of appropriate financing and reimbursement models for PM challenge the translation of PM interventions into clinical practice. Policymakers and other stakeholders around the world could concentrate their efforts in removing these barriers to stimulate public-private financing of PM R&D and achieve performance-based reimbursement agreements of PM with proven clinical and cost effectiveness.

References

European Council Conclusion on personalised medicine for patients (2015/C 421/03). Accessed on 21 October 2019. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52015XG1217(01)&from=EN.

Phillips KA, Trosman JR, Kelley RK, Pletcher MJ, Douglas MP, Weldon CB. Genomic sequencing: assessing the health care system, policy, and big-data implications. Health Aff (Millwood). 2014;33(7):1246–53.

Personalized Medicine Coalition. Personalized Medicine at FDA: The Scope and Significance of Progress in 2020. Report 2020. http://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/PM_at_FDA_A_Progress_and_Outlook_Report.pdf.

Nimmesgern E, Norstedt I, Draghia-Akli R. Enabling personalized medicine in Europe by the European Commission’s funding activities. Per Med. 2017;14(4):355–65.

International Consortium for Personalised Medicine (ICPerMed). Accessed on 12 October 2021. https://www.icpermed.eu/.

Stark Z, Dolman L, Manolio TA, Ozenberger B, Hill SL, Caulfied MJ, et al. Integrating genomics into healthcare: a global responsibility. Am J Hum Genet. 2019;104(1):13–20.

Khoury MJ, Bowen MS, Burke W, Coates RJ, Dowling NF, Evans JP, et al. Current priorities for public health practice in addressing the role of human genomics in improving population health. Am J Prev Med. 2011;40(4):486–93.

Ginsburg GS, Phillips KA. Precision medicine: from science to value. Health Aff (Millwood). 2018;37(5):694–701.

Roberts MC, Kennedy AE, Chambers DA, Khoury MJ. The current state of implementation science in genomic medicine: opportunities for improvement. Genet Med. 2017;19(8):858–63.

Touchot N, Flume M. Early insights from commercialization of gene therapies in Europe. Genes. 2017;8(2):78.

Phillips KA. Evolving payer coverage policies on genomic sequencing tests: beginning of the end or end of the beginning? JAMA. 2019;319(23):2379–80.

National Institute for Health and Care Excellence. Accessed on 25 March 2021. https://www.nice.org.uk/guidance/ta630.

Jorgensen J, Kefalas P. Annuity payments can increase patient access to innovative cell and gene therapies under England’s net budget impact test. J Mark Access Health Policy. 2017;5(1):1355203.

Govaerts L, Simoens S, Van Dyck W, Huys I. Shedding light on reimbursement policies of companion diagnostics in European Countries. Value in Health. 2020;23(5):606–15.

Koleva-Kolarova R, Tsiachristas A, Buchanan J, Wordsworth S. Systematic review of financing and reimbursement models for personalised medicine. PROSPERO 2019 CRD42019146764. Accessed on 21 October 2019. https://www.crd.york.ac.uk/prospero/display_record.php?ID=CRD42019146764.

Moher D, Liberati A, Tetzlaff J, Altman DG. Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. BMJ. 2009;339:b2535.

Personalized Medicine Coalition. Accessed on 12 October 2021. http://www.personalizedmedicinecoalition.org/.

European Alliance for Personalised Medicine. Accessed on 12 October 2021. https://www.euapm.eu/.

International Society of Pharmacoeconomics and Outcomes Research Special Interest Groups: Precision Medicine and Advanced Therapies. Accessed on 12 October 2021. https://www.ispor.org/member-groups/special-interest-groups/personalized-precision-medicine.

International Society of Pharmacoeconomics and Outcomes Research Special Interest Groups: Medical Devices and Diagnostics. Accessed on 12 October 2021. Available from: https://www.ispor.org/member-groups/special-interest-groups/medical-devices-and-diagnostics.

International Society of Pharmacoeconomics and Outcomes Research Special Interest Groups: Rare Diseases. Accessed on 12 October 2021. https://www.ispor.org/member-groups/special-interest-groups/rare-disease.

International Federation of Health Plans. Accessed on 12 October 2021. http://www.ifhp.com/.

European Network for Health Technology Assessment. Accessed on 12 October 2021. https://eunethta.eu/.

Bramer WM, Giustini D, de Jonge GB, Holland L, Bekhuiset T. De-duplication of database search results for systematic reviews in EndNote. J Med Libr Assoc. 2016;104(3):240–3.

Oordt-Speets AM, Bolijn R, van Hoorn RC, Bhavsar A, Kyaw MH. Global etiology of bacterial meningitis: a systematic review and meta-analysis. PLoS ONE. 2018;13(6):e0198772.

Sayers A. Tips and tricks in performing a systematic review. Br J Gen Pract. 2007;57(542):759.

Hanna E, Toumi M, Dussart C, Borissov B, Dabbous O, Badora K, et al. Funding breakthrough therapies: a systematic review and recommendation. Health Policy. 2018;122(3):217–29.

Carlson JJ, Sullivan SD, Garrison LP, Neumann PJ, Veenstra DL. Linking payment to health outcomes: a taxonomy and examination of performance-based reimbursement schemes between healthcare payers and manufacturers. Health Policy. 2010;96(3):179–90.

Mechanic RE, Altman SH. Payment reform options: episode payment is a good place to start. Health Aff (Millwood). 2009;28(2):w262–71.

Polychronakos C. Public funding for genomics: where does Canada stand? J Med Genet. 2012;49(8):481–2.

Power A, Berger AC, Ginsburg GS. Genomics-enabled drug repositioning and repurposing: insights from an IOM roundtable activity. JAMA. 2014;311(20):2063–4.

Prasanna PG, Narayanan D, Hallett K, Bernhard EJ, Ahmed MM, Evans G, et al. Radioprotectors and radiomitigators for improving radiation therapy: the small business innovation research (SBIR) gateway for accelerating clinical translation. Radiat Res. 2015;184(3):235–48.

Radda GK, Viney I. From gene function to improved health: genome research in the United Kingdom. J Mol Med. 2004;82(2):74–90.

Ratner M. ARRA boosts cancer programs but impact on personalized medicine unclear. Nat biotechnol. 2009;27(12):1062.

Rosenmayr-Templeton L. An industry update: What’s new in the field of therapeutic delivery? Ther Deliv. 2017;8(12):1027–33.

Sankar PL, Parker LS. The Precision Medicine Initiative’s All of Us Research Program: an agenda for research on its ethical, legal, and social issues. Genet Med. 2017;19(7):743–50.

Shah SH, Arnett D, Houser SR, Ginsburg GS, MacRae C, Mital S, et al. Opportunities for the cardiovascular community in the precision medicine initiative. Circulation. 2016;133(2):226–31.

Shanks E, Ketteler R, Ebner D. Academic drug discovery within the United Kingdom: Aa reassessment. Nat Rev Drug Discovery. 2015;14(7):510.

Siebert U, Jahn B, Rochau U, Schnell-Inderst P, Kisser A, Hunger T, et al. Oncotyrol - Center for Personalized Cancer Medicine: Methods and Applications of Health Technology Assessment and Outcomes Research. Zeitschrift Fur Evidenz Fortbildung Und Qualitaet Im Gesundheitswesen. 2015;109(4–5):330–40.

Sinclair A, Islam S, Jones S. Gene therapy: an overview of approved and pipeline technologies. Can Agency Drugs Technol Health. 2016;171:1–23.

Sorlie PD, Sholinsky PD, Lauer MS. Reinvestment in government-funded research: a great way to share. Circulation. 2015;131(1):17–8.

Steven BG. Pharmaceutical Dealmaking Broadens its Partnering Base: Collaborative R&D models coincide with new ways to fund translational research. BioPharm Int. 2012;25(7):16–7.

Stulberg E, Fravel D, Proctor LM, Murray DM, LoTempio J, Chrisey L, et al. An assessment of US microbiome research. Nat. 2016;1:15015.

Syme R, Carleton B, Leyens L, Richer E. Integrating personalized medicine in the Canadian Environment: efforts facilitating oncology clinical research. Public Health Genomics. 2015;18(6):372–80.

Vis DJ, Lewin J, Liao RG, Mao M, Andre F, Ward RL, et al. Towards a global cancer knowledge network: dissecting the current international cancer genomic sequencing landscape. Ann Oncol. 2017;28(5):1145–51.

Kudrin A. Business models and opportunities for cancer vaccine developers. Hum Vaccin Immunother. 2012;8(10):1431–8.

Iizuka T, Uchida G. Promoting innovation in small markets: evidence from the market for rare and intractable diseases. J Health Econ. 2017;54:56–65.

Gurwitz D, Zika E, Hopkins MM, Gaisser S, Ibarreta D. Pharmacogenetics in Europe: barriers and opportunities. Public Health Genomics. 2009;12(3):134–41.

Hirsch BR, Schulman KA. The economics of new drugs: can we afford to make progress in a common disease? Am Soc Clin Oncol Educ Book. 2013.

Zhavoronkov A, Cantor CR. From personalized medicine to personalized science: uniting science and medicine for patient-driven, goal-oriented research. Rejuvenation Res. 2013;16(5):414–8.

Basu A, Subedi P, Kamal-Bahl S. Financing a cure for diabetes in a multipayer environment. Value Health. 2016;19(6):861–8.

Demotes-Mainard J, Canet E, Segard L. Public-private partnership models in France and in Europe. Therapie. 2006;61(4):325–34 (13-23).

Agarwal A, Ressler D, Snyder G. The current and future state of companion diagnostics. Pharm. 2015;8:99–110.

Chignard M, Ramphal R. Basic research funding by philanthropic organizations: a case in point. Am J Respir Crit Care Med. 2013;188(11):1376–8.

Glick JL. Multiyear patterns regarding the relative availability of venture capital for the US biotechnology industry. J Commer Biotechnol. 2009;15(4):324–34.

Innovahealth conference. Building an Open Innovation ecosystem in Europe for healthcare. Report 2012. https://www.euapm.eu/pdf/EAPM_iNNOVAHEALTH_Final_Report.pdf.

Sanne JL. Horizon 2020 SME-Instrument topic: clinical research for the validation of biomarkers and/or diagnostic medical devices. Pers Med. 2018;15(4):303–9.

Hong JLA, Brechbiel M, Buchsbaum J, Canaria CA, Coleman CN, Escorcia FE, et al. National Cancer Institute support for targeted alpha-emitter therapy. Eur J Nucl Med Mol Imaging. 2021:9.

Rosenmayr-Templeton L. Industry update for May 2019. Ther Deliv. 2019;10(9):555–61.

Simpson I. Therapeutic delivery: industry update covering January 2019. Ther Deliv. 2019;10(5):273–80.

Vuga LJ, Aggarwal NR, Reineck LA, Kalantari R, Banerjee K, Kiley J. Rare Lung Disease Research: National Heart, Lung, and Blood Institute’s Commitment to Partnership and Progress. Chest. 2019;156(3):438–44.

Romagnuolo I, Mariut C, Mazzoni A, Santis G, Moltzen E, Ballensiefen W, et al. Sino-European science and technology collaboration on personalized medicine: overview, trends and future perspectives. Pers Med. 2021;18(5):455–70.

Singer DRJ, Marsh A. Challenges and solutions for personalizing medicines. Health Policy Technol. 2012;1(1):50–7.

Rasi G. Promoting innovation at National level. Pharma Policy Law. 2010;12(1–2):125–7.

Ward JC. Oncology reimbursement in the era of personalized medicine and big data. J Oncol Pract. 2014;10(2):83–6.

Jorgensen J, Kefalas P. Reimbursement of licensed cell and gene therapies across the major European healthcare markets. J Mark Access Health Policy. 2015;3:103420.

Ramsey SD, Sullivan SD. A new model for reimbursing genome-based cancer care. Oncologist. 2014;19(1):1–4.

Trosman JR, Weldon CB, Gradishar WJ, Benson A, Cristofanilli M, Kurian AW, et al. From the past to the present: insurer coverage frameworks for next-generation tumor sequencing. Value Health. 2018;21(9):1062–8.

van Waalwijk van Doorn-Khosrovani SB, Pisters-van Roy A, van Saase L, van der Graaff M, Gijzen J, Sleijfer S, et al. Personalised reimbursement: a risk-sharing model for biomarker-driven treatment of rare subgroups of cancer patients. Ann Oncol. 2019;30(5):663-5.

Faulkner A, Mahalatchimy A. The politics of valuation and payment for regenerative medicine products in the UK. New Genet Soc. 2018;37(3):227–47.

Duhig AM, Saha S, Smith S, Kaufman S, Hughes J. The current status of outcomes-based contracting for manufacturers and payers: an AMCP membership survey. J Manag Care Spec Pharm. 2018;24(5):410–5.

de Souza JA, Ratain MJ, Fendrick AM. Value-based insurance design: aligning incentives, benefits, and evidence in oncology. J Natl Compr Canc Netw. 2012;10(1):18–23.

Danzon PM. Affordability challenges to value-based pricing: mass diseases, orphan diseases, and cures. Value in Health. 2018;21(3):252–7.

Akhmetov I, Bubnov RV. Innovative payer engagement strategies: will the convergence lead to better value creation in personalized medicine? Epma J. 2017;8(1):5–15.

MIT NEWDIGS White Paper 2019F201-v023 Precision Financing Solutions for Durable / Potentially Curative Therapies. White paper 2019. https://newdigs.mit.edu/sites/default/files/MIT%20FoCUS%20Precision%20Financing%202019F201v023.pdf.

Personalized Medicine Coalition. Paying for personalized medicine: how alternative payment models could help or hinder the field. White paper 2015. https://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/paying_for_personalized_medicine.pdf.

Carr DR, Bradshaw SE. Gene therapies: the challenge of super-high-cost treatments and how to pay for them. Regen Med. 2016;11(4):381–93.

Editorial. Gene therapy's next installment. Nat biotechnol. 2019;37(7):697.

Picecchi D, Bertram K, Brucher D, Bauer M. Towards novel reimbursement models for expensive advanced therapy medicinal products (ATMPs). Swiss Med Wkly. 2020;150:w20355.

Horgan D, Metspalu A, Ouillade MC, Athanasiou D, Pasi J, Adjali O, et al. Propelling healthcare with advanced therapy medicinal products: a policy discussion. Biomed. 2020;5(3):130–52.

Pearson SD, Dreitlein WB, Henshall C, Towse A. Indication-specific pricing of pharmaceuticals in the US healthcare system. J Comp Eff Res. 2017;6(5):397–404.

Dinan MA, Lyman GH, Schilsky RL, Hayes DF. Proposal for value-based, tiered reimbursement for tumor biomarker tests to promote innovation and evidence generation. JCO Precis Oncol. 2019;3:1–10.

Senior M. Rollout of high-priced cell and gene therapies forces payer rethink. Nat biotechnol. 2018;36(4):291–2.

Pothier K, Gustavsen G. Combating complexity: partnerships in personalized medicine. Pers Med. 2013;10(4):387–96.

Salzman R, Cook F, Hunt T, Malech HL, Reilly P, Foss-Campbell B, et al. Addressing the value of gene therapy and enhancing patient access to transformative treatments. Mol Ther. 2018;26(12):2717–26.

Abou-El-Enein M, Elsanhoury A, Reinke P. Overcoming challenges facing advanced therapies in the EU market. Cell Stem Cell. 2016;19(3):293–7.

Yu TTL, Gupta P, Ronfard V, Vertes AA, Bayon Y. Recent progress in European advanced therapy medicinal products and beyond. Front. 2018;6:130.

Pauly MV. Cost Sharing in Insurance Coverage for Precision Medicine. National Bureau of Economic Research, Inc, NBER Working Papers: 24095; 2017.

Petelin L, James PA, Trainer AH. Changing landscape of hereditary breast and ovarian cancer germline genetic testing in Australia. Int Med J. 2018;48(10):1269–72.

Plothner M, Klora M, Rudolph D, Graf von der Schulenburg JM. Health-Related Genetic Direct-to-Consumer Tests in the German Setting: The Available Offer and the Potential Implications for a Solidarily Financed Health-Care System. Public Health Genomics. 2017;20(4):203-17.

Plun-Favreau J, Immonen-Charalambous K, Steuten L, Strootker A, Rouzier R, Horgan D, et al. Enabling equal access to molecular diagnostics: what are the implications for policy and health technology assessment? Public Health Genomics. 2016;19(3):144–52.

Powell A, Chandrasekharan S, Cook-Deegan R. Spinocerebellar ataxia: patient and health professional perspectives on whether and how patents affect access to clinical genetic testing. Genet Med. 2010;12(4 Suppl):S83–110.

Ramsey SD, Veenstra D, Tunis SR, Garrison L, Crowley JJ, Baker LH. How comparative effectiveness research can help advance “personalized medicine” in cancer treatment. Health Aff (Millwood). 2011;30(12):2259–68.

Roberts MC, Dusetzina SB. Use and Costs for Tumor Gene Expression Profiling Panels in the Management of Breast Cancer From 2006 to 2012: Implications for Genomic Test Adoption Among Private Payers. J Oncol Pract. 2015;11(4):273–7.

Ross JS, Hatzis C, Symmans WF, Pusztai L, Hortobagyi GN. Commercialized multigene predictors of clinical outcome for breast cancer. Oncologist. 2008;13(5):477–93.

Ross W, Lynch P, Raju G, Rodriguez A, Burke T, Hafemeister L, et al. Biomarkers, bundled payments, and colorectal cancer care. Genes Cancer. 2012;3(1):16–22.

Ryska A, Berzinec P, Brcic L, Cufer T, Dziadziuszko R, Gottfried M, et al. NSCLC molecular testing in Central and Eastern European countries. BMC Cancer. 2018;18(1):269.

Ryska A, Buiga R, Fakirova A, Kern I, Olszewski W, Plank L, et al. Non-Small Cell Lung Cancer in Countries of Central and Southeastern Europe: Diagnostic Procedures and Treatment Reimbursement Surveyed by the Central European Cooperative Oncology Group. Oncologist. 2018;23(12):E152–8.

Shah A, Harris H, Brown T, Graf MD, Sparks L, Mullins T, et al. Analysis of insurance preauthorization requests for BRCA1 and BRCA2 genetic testing: experience of the Humana Genetic Guidance Program. Pers Med. 2011;8(5):563–9.

Shah P, Nathanson K, Holmes AM, Hadjiliadis D. Diagnosis of adult hereditary pulmonary disease and the role of genetic testing. Chest. 2010;137(4):976–82.

Steffen JA. Diffusion of molecular diagnostic lung cancer tests: a survey of german oncologists. J. 2014;4(1):102-14.

Sullivan R, Peppercorn J, Sikora K, Zalcberg J, Meropol NJ, Amir E, et al. Delivering affordable cancer care in high-income countries. Lancet Oncol. 2011;12(10):933–80.

Sutherland S, Farrell RM, Lockwood C. Genetic screening and testing in an episode-based payment model: preserving patient autonomy. Obstet Gynecol. 2014;124(5):987–91.

Towse A, Garrison L. Value assessment in precision cancer medicine. J Cancer Policy. 2017;11:48–53.

Towse A, Garrison LP Jr. Economic incentives for evidence generation: promoting an efficient path to personalized medicine. Value in Health. 2013;16(6 Suppl):S39-43.

Towse A, Ossa D, Veenstra D, Carlson J, Garrison L. Understanding the economic value of molecular diagnostic tests: case studies and lessons learned. J. 2013;3(4):288-305.

Walcoff SD, Pfeifer JD. Modernizing US regulatory and reimbursement policy to support continued innovation in genomic pathology. Pers Med. 2012;9(3):295–308.

Wu AC, Mazor KM, Ceccarelli R, Loomer S, Lu CY. The Implementation Process for Pharmacogenomic Testing for Cancer-Targeted Therapies. J. 2018;8(4):01.

Wurcel V, Perche O, Lesteven D, Williams DA, Schafer B, Hopley C, et al. The Value of Companion Diagnostics: Overcoming Access Barriers to Transform Personalised Health Care into an Affordable Reality in Europe. Public Health Genomics. 2016;19(3):137–43.

Hayes DF, Allen J, Compton C, Gustavsen G, Leonard DGB, McCormack R, et al. Breaking a Vicious Cycle. Science Translational Medicine. 2013;5(196):196cm6-cm6.

Hilal T, Betcher JA, Leis JF. Economic impact of oral therapies for chronic lymphocytic leukemia-the burden of novelty. Curr Hematol Malig Rep. 2018;13(4):237–43.

Hsiao SJ, Mansukhani MM, Carter MC, Sireci AN. The History and Impact of Molecular Coding Changes on Coverage and Reimbursement of Molecular Diagnostic Tests: Transition from Stacking Codes to the Current Molecular Code Set Including Genomic Sequencing Procedures. J Mol Diagn. 2018;20(2):177–83.

Klein RD. Reimbursement in molecular pathology: bringing genomic medicine to patients. Clin Chem. 2015;61(1):136–8.

Kudrin A. Reimbursement challenges with cancer immunotherapeutics. Hum Vaccin Immunother. 2012;8(9):1326–34.

Leopold C, Vogler S, Habl C, Mantel-Teeuwisse AK, Espin J. Personalised medicine as a challenge for public pricing and reimbursement authorities—a survey among 27 European countries on the example of trastuzumab. Health Policy. 2013;113(3):313–22.

Meckley LM, Neumann PJ. Personalized medicine: factors influencing reimbursement. Health Policy. 2010;94(2):91–100.

Merlin T, Farah C, Schubert C, Mitchell A, Hiller JE, Ryan P. Assessing personalized medicines in Australia: a national framework for reviewing codependent technologies. Med Decis Making. 2013;33(3):333–42.

Mihajlovic J, Dolk C, Tolley K, Simoens S, Postma MJ. Reimbursement of targeted cancer therapies within 3 different European health care systems. Clin Ther. 2015;37(2):474–80.

Cohen JP, Felix AE. Personalized Medicine's Bottleneck: Diagnostic Test Evidence and Reimbursement. J. 2014;4(2):163-75.

Cohen J, Wilson A, Manzolillo K. Clinical and economic challenges facing pharmacogenomics. Pharmacogenomics J. 2013;13(4):378–88.

Garfield S. Advancing Access to Personalized Medicine: A Comparative Assessment of European Reimbursement Systems. Personalized Medicine Coalition. Bridgehead International. 2011. http://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/pmc_bridgehead_issue_brief_european_reimbursement.pdf.

Institute of Medicine (US). Genome-Based Diagnostics: Clarifying Pathways to Clinical Use: Workshop Summary. Washington (DC): National Academies Press (US); 2012. PMID: 22934323.

Wilsdon T, Barron A, Edwards G, Lawlor R, Charles River Associates. The benefits of personalised medicine to patients, society and healthcare systems. Final Report 2018. https://www.efpia.eu/media/362040/cra-ebe-efpia-benefits-of-pm-final-report-6-july-2018.pdf.

Sireci AN, Aggarwal VS, Turk AT, Gindin T, Mansukhani MM, Hsiao SJ. Clinical genomic profiling of a diverse array of oncology specimens at a large academic cancer center: identification of targetable variants and experience with reimbursement. J Mol Diagn. 2017;19(2):277–87.

Miller I, Ashton-Chess J, Spolders H, Fert V, Ferrara J, Kroll W, et al. Market access challenges in the EU for high medical value diagnostic tests. Pers Med. 2011;8(2):137–48.

Campbell JD, Whittington MD. Paying for CAR-T therapy amidst limited health system resources. J Clin Oncol. 2019;37(24):2095–7.

Jacobson C, Emmert A, Rosenthal MB. CAR T-cell therapy: a microcosm for the challenges ahead in medicare. JAMA. 2019;322(10):923–4.

Leech AA, Dusetzina SB. Cost-effective but unaffordable: the CAR-T conundrum. J Natl Cancer Inst. 2019;111(7):644–5.

Fiorenza S, Ritchie DS, Ramsey SD, Turtle CJ, Roth JA. Value and affordability of CAR T-cell therapy in the United States. Bone Marrow Transp. 2020;55(9):1706–15.

Jorgensen J, Hanna E, Kefalas P. Outcomes-based reimbursement for gene therapies in practice: the experience of recently launched CAR-T cell therapies in major European countries. J Mark Access Health Policy. 2020;8(1):1715536.

Kansagra A, Farnia S, Majhail N. Expanding access to chimeric antigen receptor T-cell therapies: challenges and opportunities. Am Soc Clin Oncol Educ Book. 2020;40:1–8.

Jorgensen J, Kefalas P. The use of innovative payment mechanisms for gene therapies in Europe and the USA. Regen Med. 2021;16(4):405–22.

Ronco V, Dilecce M, Lanati E, Canonico PL, Jommi C. Price and reimbursement of advanced therapeutic medicinal products in Europe: are assessment and appraisal diverging from expert recommendations? Journal of Pharmaceutical Policy and Practice. 2021;14(30).

Sharpe M, Barry J, Kefalas P. Clinical adoption of advanced therapies: challenges and opportunities. J Pharm Sci. 2021;110(5):1877–84.

Wilking N, Bucsics A, Kandolf Sekulovic L, Kobelt G, Laslop A, Makaroff L, et al. Achieving equal and timely access to innovative anticancer drugs in the European Union (EU): Summary of a multidisciplinary CECOG-driven roundtable discussion with a focus on Eastern and South-Eastern EU countries. ESMO Open. 2019;4(6):e000550.

Kandolf Sekulovic L, Guo J, Agarwala S, Hauschild A, McArthur G, Cinat G, et al. Access to innovative medicines for metastatic melanoma worldwide: melanoma World Society and European Association of Dermato-oncology survey in 34 countries. Eur J Cancer. 2018;104:201–9.

Hsiao SJ, Sireci AN, Pendrick D, Freeman C, Fernandes H, Schwartz GK, et al. Clinical utilization, utility, and reimbursement for expanded genomic panel testing in adult oncology. JCO Precis Oncol. 2020;4:1038–48.

Klein RD. Current policy challenges in genomic medicine. Clin Chem. 2020;66(1):61–7.

Rogers SL, Keeling NJ, Giri J, Gonzaludo N, Jones JS, Glogowski E, et al. PARC report: a health-systems focus on reimbursement and patient access to pharmacogenomics testing. Pharmacogenomics. 2020;21(11):785–96.

Thunnissen E, Weynand B, Udovicic-Gagula D, Brcic L, Szolkowska M, Hofman P, et al. Lung cancer biomarker testing: perspective from Europe. Transl. 2020;9(3):887–97.

Mullangi S, Schleicher SM, Parikh RB. The oncology care model at 5 years-value-based payment in the Precision Medicine Era. JAMA Oncol. 2021;7(9):1283–4.

Pruneri G, Tondini CA. The use of genomic tests in patients with breast cancer in Lombardy: a successful healthcare model. Tumori. 2021;107(2):166–70.

Andersson E, Svensson J, Persson U, Lindgren P. Risk sharing in managed entry agreements—a review of the Swedish experience. Health Policy. 2020;124(4):404–10.

Pauwels K, Huys I, Vogler S, Casteels M, Simoens S. Managed entry agreements for oncology drugs: lessons from the European experience to inform the future. Front Pharmacol. 2017;8:171.

Dabbous M, Chachoua L, Caban A, Toumi M. Managed entry agreements: policy analysis from the European perspective. Value Health. 2020;23(4):425–33.

Whittington MD, McQueen RB, Campbell JD. Valuing chimeric antigen receptor T-cell therapy: current evidence, uncertainties, and payment implications. J Clin Oncol. 2020;38(4):359–66.

Starner CI, Gleason PP. Spinal muscular atrophy therapies: ICER grounds the price to value conversation in facts. J Manag Care Spec Pharm. 2019;25(12):1306-8.

Faulkner E, Annemans L, Garrison L, Helfand M, Holtorf AP, Hornberger J, et al. Challenges in the development and reimbursement of personalized medicine-payer and manufacturer perspectives and implications for health economics and outcomes research: a report of the ISPOR Personalized Medicine Special Interest Group. Value Health. 2012;15(8):1162–71.

Cohen JP. Personalized medicine: are payers the weak link? Pers Med. 2011;8(3):293–6.

Abou-El-Enein M, Bauer G, Medcalf N, Volk HD, Reinke P. Putting a price tag on novel autologous cellular therapies. Cytotherapy. 2016;18(8):1056–61.

Fugel HJ, Nuijten M, Postma M. Stratified medicine and reimbursement issues. Front Pharmacol. 2012;3:181.

Garrison LP, Jackson T, Paul D, Kenston M. Value-based pricing for emerging gene therapies: the economic case for a higher cost-effectiveness threshold. J Manag Care Spec Pharm. 2019;25(7):793–9.

Blair ED, Stratton EK, Kaufmann M. Aligning the economic value of companion diagnostics and stratified medicines. J. 2012;2(4):257-66.

Garrison LP, Towse A. Value-Based Pricing and Reimbursement in Personalised Healthcare: Introduction to the Basic Health Economics. J. 2017;7(3):04.

Garrison LP Jr, Carlson RJ, Carlson JJ, Kuszler PC, Meckley LM, Veenstra DL. A review of public policy issues in promoting the development and commercialization of pharmacogenomic applications: challenges and implications. Drug Metab Rev. 2008;40(2):377–401.

Crawford JM, Aspinall MG. The business value and cost-effectiveness of genomic medicine. Pers Med. 2012;9(3):265–86.

Brooks GA, Bosserman LD, Mambetsariev I, Salgia R. Value-based medicine and integration of tumor biology. Am. 2017;37:833–40.

Lyerly HK, Ren J, Canetta R, Kim GH, Nagai S, Yamaguchi T, et al. Global development of anticancer therapies for rare cancers, pediatric cancers, and molecular subtypes of common cancers. J Glob Oncol. 2018;4:1–11.

Lennerz JK, McLaughlin HM, Baron JM, Rasmussen D, Shin MS, Berners-Lee N, et al. Health care infrastructure for financially sustainable clinical genomics. J Mol Diagn. 2016;18(5):697–706.

Personalized Medicine Coalition. The future of coverage and payment for personalized medicine diagnostics. White paper 2014. http://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/pmc_the_future_coverage_payment_personalized_medicine_diagnostics.pdf.

Engstrom PF, Bloom MG, Demetri GD, et al. NCCN molecular testing white paper: effectiveness, efficiency, and reimbursement. J Natl Compr Canc Netw. 2011;9(suppl 6):S1–16.

Knowles L, Luth W, Bubela T. Paving the road to personalized medicine: recommendations on regulatory, intellectual property and reimbursement challenges. J Law Biosci. 2017;4(3):453–506.

Merlin T. The use of the “linked evidence approach” to guide policy on the reimbursement of personalized medicines. Pers Med. 2014;11(4):435–48.

Grabowski HG, DiMasi JA, Long G. The roles of patents and research and development incentives in biopharmaceutical innovation. Health Aff (Millwood). 2015;34(2):302–10.

Greaves RF, Bernardini S, Ferrari M, Fortina P, Gouget B, Gruson D, et al. Key questions about the future of laboratory medicine in the next decade of the 21st century: a report from the IFCC-Emerging Technologies Division. Clin Chim Acta. 2019;495:570–89.

Koh CYC, Seager TP. Value-based pharmaceutical pricing from the patient perspective could incentivize innovation. Pharm Med. 2017;31(3):149–53.

Vozikis A, Cooper DN, Mitropoulou C, Kambouris ME, Brand A, Dolzan V, et al. Test pricing and reimbursement in genomic medicine: towards a general strategy. Public Health Genomics. 2016;19(6):352–63.

Halfmann SSG, Evangelatos N, Schroder-Back P, Brand A. European healthcare systems readiness to shift from “one-size fits all” to personalized medicine. Pers Med. 2017;14(1):63–74.

Antonanzas F, Rodriguez-Ibeas R, Juarez-Castello CA. Personalized medicine and pay for performance: should pharmaceutical firms be fully penalized when treatment fails? Pharmacoeconomics. 2018;36(7):733–43.

Emery JCH, Zwicker JD. Innovation, productivity, and pricing: capturing value from precision medicine technology in Canada. Healthc Manage Forum. 2017;30(4):197–9.

Deverka PA, Dreyfus JC. Clinical integration of next generation sequencing: coverage and reimbursement challenges. J Law Med Ethics. 2014;42(Suppl 1):22–41.

Deverka PA. Pharmacogenomics, evidence, and the role of payers. Public Health Genomics. 2009;12(3):149–57.

Danko D, Blay JY, Garrison LP. Challenges in the value assessment, pricing and funding of targeted combination therapies in oncology. Health Policy. 2019;123(12):1230–6.

Garrison LP Jr, Towse A. A strategy to support efficient development and use of innovations in personalized medicine and precision medicine. J Manag Care Spec Pharm. 2019;25(10):1082–7.

Faulkner E, Holtorf AP, Walton S, Liu CY, Lin H, Biltaj E, et al. Being precise about precision medicine: what should value frameworks incorporate to address precision medicine? a report of the Personalized Precision Medicine Special Interest Group. Value Health. 2020;23(5):529–39.

Phillips KA, Douglas MP, Wordsworth S, Buchanan J, Marshall DA. Availability and funding of clinical genomic sequencing globally. BMJ Glob Health. 2021;6(2):e004415.

Michelsen S, Nachi S, Van Dyck W, Simoens S, Huys I. Barriers and opportunities for implementation of outcome-based spread payments for high-cost, one-shot curative therapies. Front Pharmacol. 2020;11:594446.

Horgan D, Ciliberto G, Conte P, Baldwin D, Seijo L, Montuenga LM, et al. Bringing greater accuracy to Europe’s Healthcare Systems: the unexploited potential of biomarker testing in oncology. Biomed. 2020;5(3):182–223.

Personalized Medicine Coalition. Understanding genomic testing utilization and coverage in the US. Report 2020. https://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/PMC_Understanding_Genomic_Testing_Utilization_and_Coverage_in_the_US2.pdf.

Personalized Medicine Coalition. Personalized Medicine At FDA: A Progress & Outlook Report. Report 2019. https://www.personalizedmedicinecoalition.org/Userfiles/PMC-Corporate/file/PM_at_FDA_A_Progress_and_Outlook_Report.pdf.

Frueh FW. Regulation, reimbursement, and the long road of implementation of personalized medicine-a perspective from the United States. Value in Health. 2013;16(6):S27–31.

Cherla A, Howard N, Mossialos E. The “Netflix plus model”: can subscription financing improve access to medicines in low- and middle-income countries? Health Econ Policy Law. 2021;16(2):113–23.

Moon S, Erickson E. Universal medicine access through lump-sum remuneration—Australia’s Approach to Hepatitis C. N Engl J Med. 2019;380(7):607–10.

Financial Times. Table: the top social global impact bonds. Accessed on 4 August 2020. https://www.ft.com/content/99b49376-eea6-11e8-89c8-d36339d835c0. 2018.

Social Finance. Social Impact Bonds. Accessed on 4 August 2020. https://www.socialfinance.org.uk/what-we-do/social-impact-bonds. 2018.

Berndt C, Wirth M. Market, metrics, morals: the social impact bond as an emerging social policy instrument. Geoforum. 2018;90:27–35.

Government UK. Social Impact Bonds. Guidance. Accessed on 4 August 2020. https://www.gov.uk/guidance/social-impact-bonds. 2012.

Neumann PJ. Yes, improve the US value frameworks, but recognize they are already in prime time. Value Health. 2019;22(9):975–6.

Lakdawalla DN, Doshi JA, Garrison LP Jr, Phelps CE, Basu A, Danzon PM. Defining elements of value in health care-A health economics approach: an ISPOR special task force report [3]. Value Health. 2018;21(2):131–9.

Dakin H, Gray A. Decision making for healthcare resource allocation: joint v. separate decisions on interacting interventions. Med Decis Making. 2018;38(4):476–86.

van de Wetering EJ, van Exel J, Brouwer WB. The challenge of conditional reimbursement: stopping reimbursement can be more difficult than not starting in the first place! Value Health. 2017;20(1):118–25.

Drummond M, Towse A. Is rate of return pricing a useful approach when value-based pricing is not appropriate? Eur J Health Econ. 2019;20(7):945–8.

Flodgren G, Eccles MP, Shepperd S, Scott A, Parmelli E, Beyer FR. An overview of reviews evaluating the effectiveness of financial incentives in changing healthcare professional behaviours and patient outcomes. Cochrane Database Syst Rev. 2011;2011(7):Cd009255.

Sarnak DO, Squires D, Kuzmak G, Bishop S, Paying for Prescription Drugs Around the World: Why Is the U.S. an Outlier? The Commonwealth Fund, October 2017.

Renwick MJ, Brogan DM, Mossialos E. A systematic review and critical assessment of incentive strategies for discovery and development of novel antibiotics. J Antibiot. 2016;69(2):73–88.

Author information

Authors and Affiliations

Consortia

Corresponding author

Ethics declarations

Funding

The HEcoPerMed project has received funding from the European Union’s Horizon 2020 research and innovation programme under Grant Agreement no. 824997.

Conflict of interest